can you go to jail for not filing taxes for 5 years

If you fail to file your tax return on time the IRS can impose a penalty equivalent to 5 of your unpaid tax bill for each. If you dont file within three years of the returns due date the IRS will keep your refund money forever.

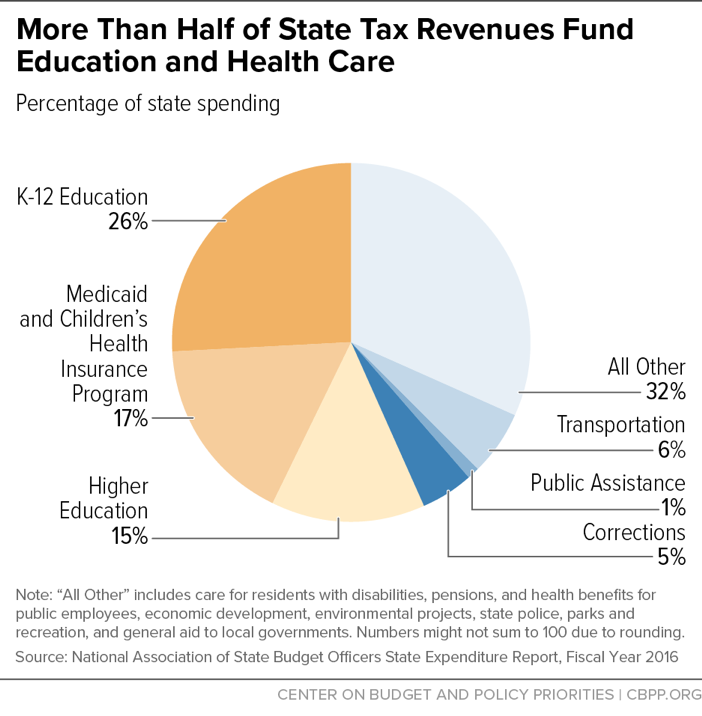

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities

But wait can you go to jail for not filing taxes.

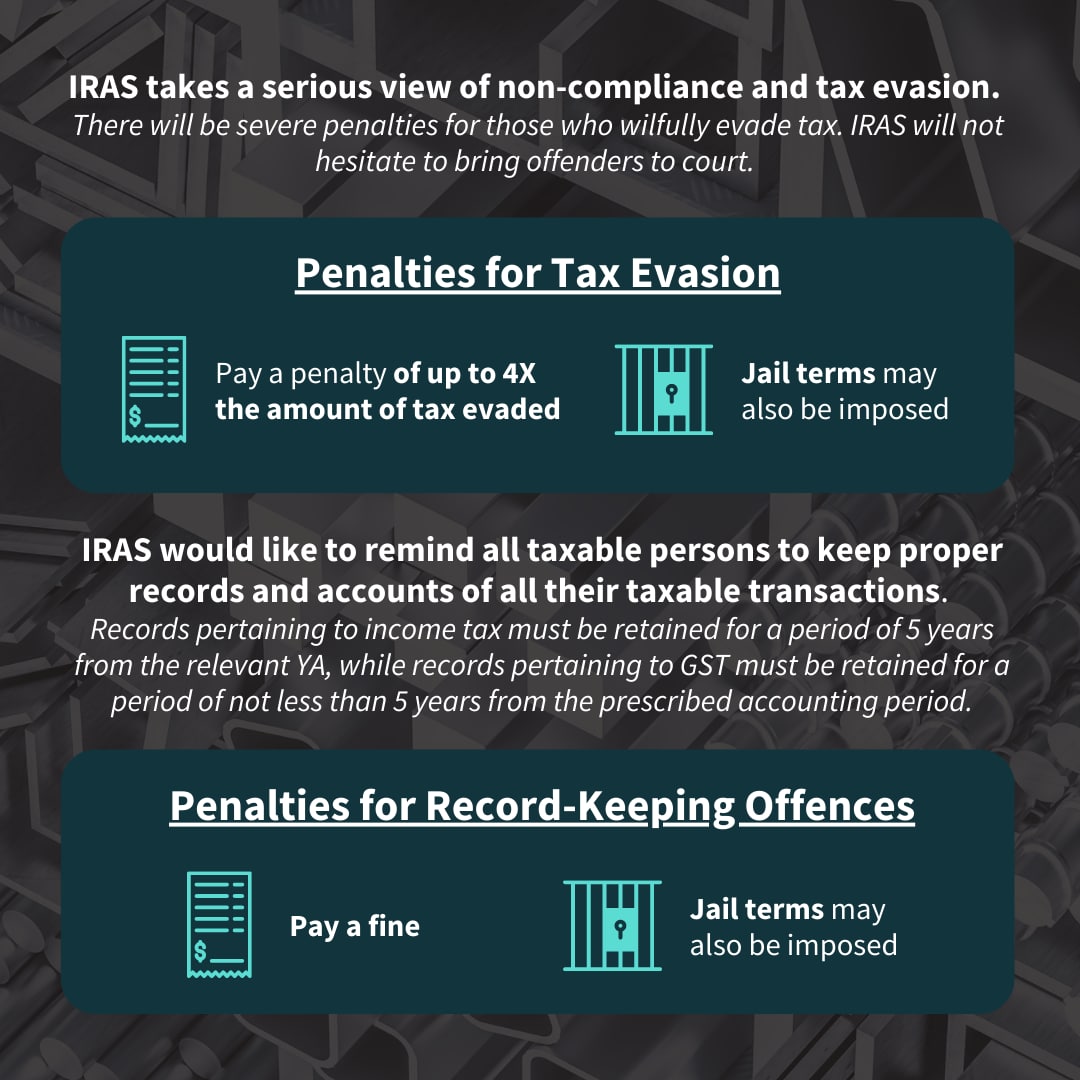

. The question can you go to jail for not filing taxes is complicated and multifaceted. Tax fraud and evasion can lead to fines up to 250000 for individuals and up to 500000 for corporations. When Can You Go to.

But only if you did so on purpose. The following actions can land you in jail for one to five years. Fraudulent withholding exemption certificate or failure to supply information.

The following actions can land you in jail for one to five years. No you can not go to jail for not paying taxes or simple tax mistakes. But the government cant prosecute you for not having enough money to pay taxes.

Penalties for Tax Fraud and Evasion. How many years can you go without filing taxes legally. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for.

How long do you go to jail for lying on your taxes. Courts will charge you up to 250000 in fines. Do I get stimulus check if I didnt file 2019 taxe.

Can I still file my 2019 taxes electronically in 202. If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due. But you can go to jail for extreme tax fraud scenarios.

The short answer is maybe. Can you go to jail for. Oftentimes youll be subject to tax penalties.

What are the consequences of non-filed tax returns. Can a person go to jail for not paying taxes. Misrepresent their income and credits in their.

Fraudulent and false statements. Can you file 3 years of taxes at onc. Any action taken to evade the assessment of a tax such as.

You can go to jail if you lied on your tax return or didnt file one. If convicted you face up to five years in prison. Can I file taxes from 5 years ag.

Although it is very unlikely for an individual to receive a jail sentence for. According to the Department of Justice McAfee couldve faced a maximum of five years in prison if found guilty of tax evasion. In the most serious cases you can even go to jail for up to five years for committing tax evasion.

Fail to file their tax returns Failing to file your tax returns can land you in jail for up to one year for every year that you failed to file your taxes. Recently worldwide headlines reported on the arrest of John McAfee an American tech expert who was hiding out in Spain after committing severe tax evasion in the US. Failure to file or failure to.

If youre required to file a tax return and you dont file you will have committed a crime. The short answer is yes you can go to jail for not paying taxes. The criminal penalties include up to one year in.

While the IRS can pursue charges against. It is a federal crime for which you can receive up to five years in prison for each offense of which. The penalty is usually 5 of the tax owed for each month or part of a month the return is late.

The maximum failure-to-file penalty is 25. Is there a one time tax forgivenes. Be guilty of a felony and upon conviction thereof shall be fined not more than 100000 500000 in the case of a corporation or imprisoned not more than 5 years or both The government is not shy about.

Will I get a stimulus check if I havent filed taxes in year. Tax evasion is defined as any action taken to evade the assessment of federal or state taxes. What happens if you havent filed taxes in 5 years.

In addition to a prison term the US. However in case you do not file taxes for a long time then you will end up paying a hefty fine. Failure to File Taxes.

Under IRS Section 7201 Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall. Failure to file a return or supply requested information. You may also face a prison sentence of up to.

If you dont file federal taxes youll be slapped with a penalty fine of 5 of your tax debt per month that theyre late capping at 25 in addition to however much money you may. If your return is more than 60 days late the minimum. Nor can you be held liable if you can prove that it was just an oversight on your part.

Can the IRS put you in jail for not filing taxe.

What Are The Penalties For Not Filing Taxes Legalzoom

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

What Happens If You Don T Report Self Employment Income

![]()

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Filing Taxes If You Are Currently Incarcerated Or Re Entering Society Get It Back

What Happens If I Filed My Taxes Wrong A Complete Guide Ageras

Can You Go To Prison For Not Paying Or Not Filing Your Taxes

Taxcrimes Twitter Search Twitter

What To Do If You Made A Mistake On Your Taxes Time

How To Avoid Jail When You Owe Back Taxes

Irs Criminal Investigation Process Irs Tax Investigation Attorney

Irs Audit Penalties And Consequences Polston Tax

Can I Go To Jail For Failure To File Tax Returns Tax Problem Attorney Blog December 13 2016

What Happens If You Don T File Your Taxes For 5 Years Or More

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

When Will The Irs File Federal Charges Against You Tax Debt Relief Services

14 Tips If You Haven T Filed Taxes In Years Upsolve